Most non-homeowners in Edmonton feel buying own home is out of reach: CityNews poll

Posted September 24, 2024 3:53 pm.

Last Updated September 25, 2024 11:12 am.

Edmontonians are feeling the financial pain when it comes to buying a new home amid a housing supply shortage and prices on the rise.

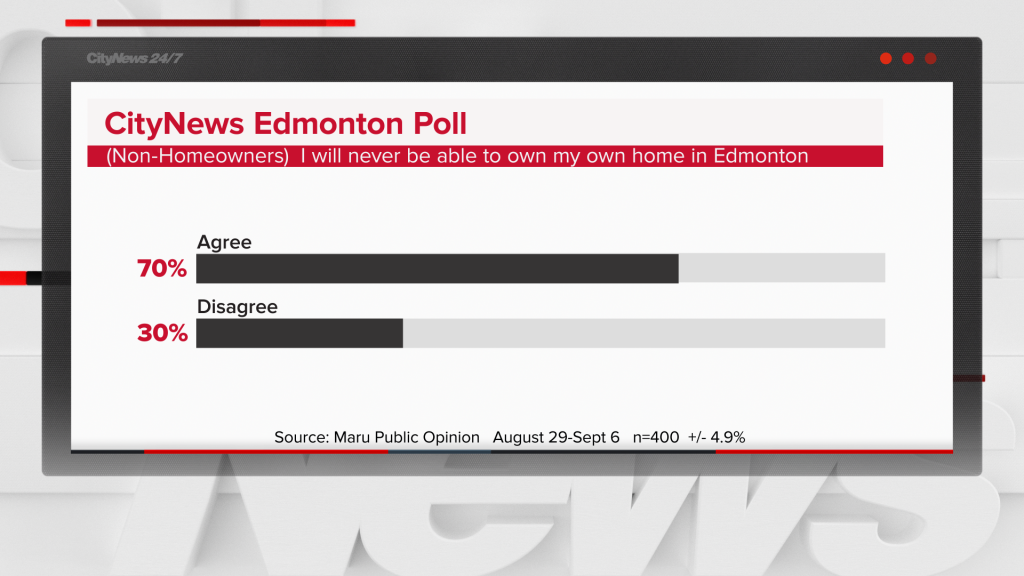

A new Maru Public Opinion commissioned by CityNews suggests a majority of Edmontonians who don’t own a home yet – 70 per cent of respondents – feel they will never be able to buy a place they call their own.

After living in Kelowna for seven years, realtor Tristan Jones decided to move back to the Edmonton region due to the rising cost of living and housing prices in B.C.

“We have kids that started to get into things, their events started to get a little bit farther to get to,” Jones told CityNews. “That, mixed with your $300-400,000 mortgage, money becomes tight. I wanted to be able to do other things with that money.

“The average home price in Edmonton and area is between $450-500,000. In Kelowna, that number jumped up to about $850-900,000. It’s just a big jump.”

Jones is seeing more people from other major cities choosing to move to Edmonton.

“It’s one of the few places that have opportunities left it seems like, so people come here.”

“Most people who are coming to Edmonton to conduct real estate are outside investors or buyers who want to live in the property themselves,” added Tom Shearer, a real estate agent with Royal LePage.

Despite Edmonton being considered “affordable” compared to other major Canadian cities, 36 per cent of Edmontonians polled say housing is their second biggest issue after affordability and cost of living.

“Maybe the house I’m trying to get into isn’t the one that I can’t afford,” Shearer said. “Also, what could hold them back is the amount of down payment they have or maybe haven’t saved up enough to enter the real estate market.”

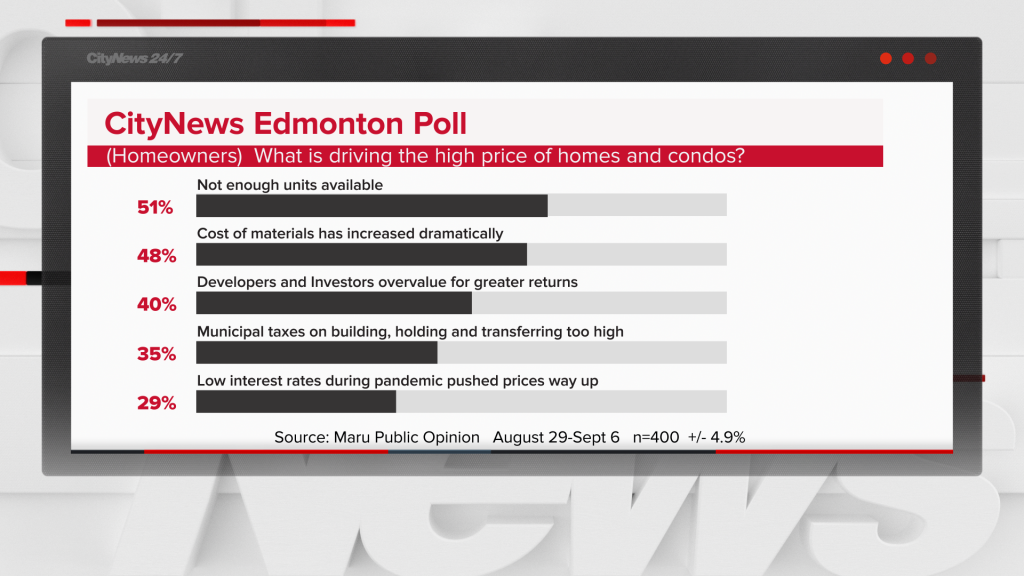

Of the home-owning Edmontonians polled part as part of the CityBeat series looking at affordability, 51 per cent believe the top factor driving the high prices of homes and condos in Edmonton is not having enough units to keep up with the demand. Other factors include the rising cost of materials, as well as overvaluing properties by developers and investors.

“There’s a need for more housing to be built and for us to be able to accommodate the number of people who are looking to find a property to live in,” Shearer said.

Is renting a better option?

Meanwhile high rent prices is what compelled Daran Downie to buy a home.

“Renters are charging more and more and I decided to purchase instead of keep paying rent,” Downie said.

“I set my priorities and what I wanted, and made moves to make that happen.”

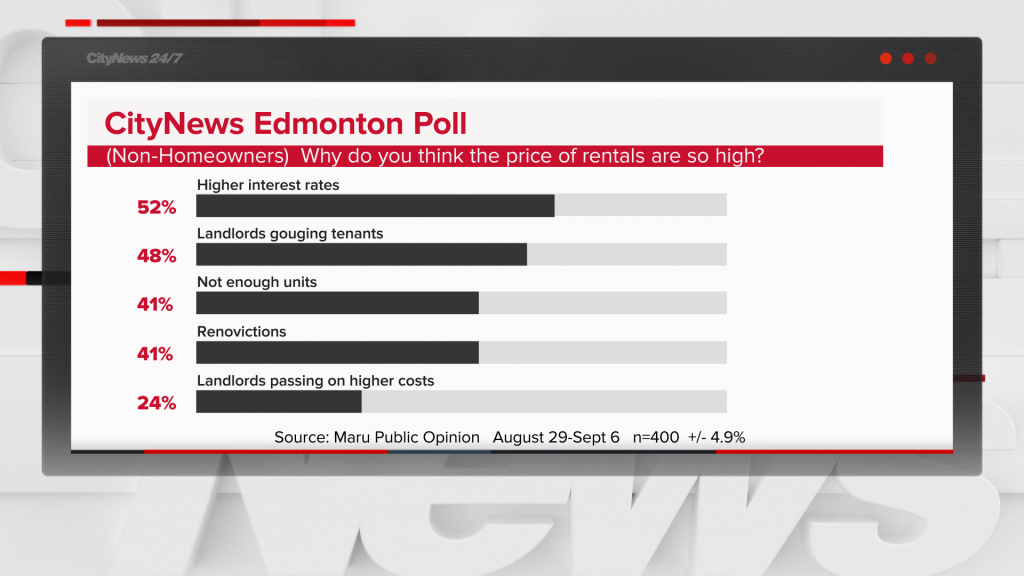

Poll respondents blamed high rent prices on high interest rates, landlords gouging tenants, and not enough supply.

Jones says renting does have to be a bad thing, especially at a time where there is significant buyer fatigue in a fluctuating housing market.

“Sometimes you get with more in your pocket every month and if that’s a benefit to you, then that’s a good thing,” the Edmonton realtor said.

The poll was conducted between August 29-September 6, 2024, among a random selection of 1,801 Canadian adults who are Unlock Surveys online panelists. Respondents were surveyed within the specific cities of Toronto, Vancouver, Edmonton and Calgary. Probability samples of this size have an estimated margin of error of plus or minus 4.4 percentage points, 19 times out of 20.