Dow Chemical delays Path2Zero project north of Edmonton due to tariff uncertainty

Posted April 24, 2025 12:00 pm.

Last Updated April 24, 2025 3:36 pm.

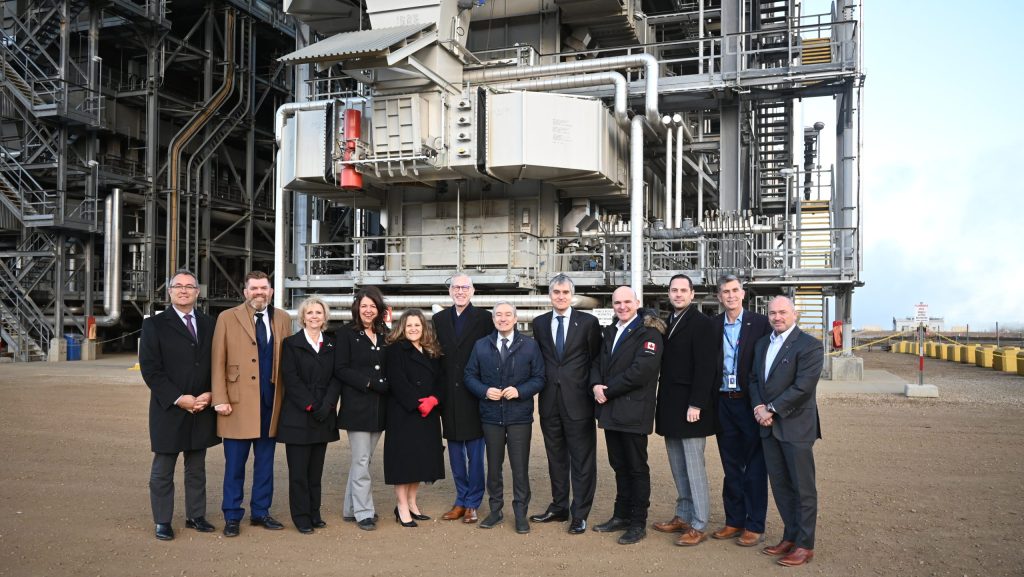

Dow Inc. says it is delaying construction of a nearly $9 billion net-zero petrochemical project northeast of Edmonton because of expected weak market conditions.

The company says it’s still committed to the Path2Zero project in Fort Saskatchewan, Alta., but that after a comprehensive review it has decided to push back the timeline.

Dow says it sees an expected lower-for-longer earnings environment ahead, so it won’t need the project’s output as early as it thought, and will hold off on restarting construction until market conditions improve.

It says the delay means it is holding off on about US$1 billion in capital spending this year.

Dow bills its Path2Zero facility as the world’s first net-zero Scope 1 and 2 greenhouse gas emissions-integrated ethylene cracker and derivatives site.

It says the project is expected to create about 5,000 jobs at peak construction and about 450 full-time jobs once operational.

This comes as tariff worries continue hanging over companies as they report their latest financial results and try to provide guidance on their path ahead.

Some tariffs remain in place against key U.S. trading partners, but others have been postponed to give nations time to negotiate. The tariff and trade picture continues shifting and that makes it difficult for companies and investors to make a reliable assessment of any impact to costs and sales.

Seemingly few industries or companies are being spared from the uncertainty. Food and beverage businesses, pharmaceutical companies, and makers of household staples are among the many companies trying to gauge the potential impact to costs and sales.

A new poll by The Associated Press-NORC Center for Public Affairs Research shows that companies are right to be focused on tariffs. About 6 in 10 U.S. adults are “extremely” or “very” concerned about the cost of groceries in the next few months, while about half are highly concerned about the cost of big purchases, such as a car, cellphone or appliance.

Other companies facing potential impacts

Procter & Gamble

Procter & Gamble, the maker of such products as Crest toothpaste, Tide detergent and Charmin toilet paper, said Thursday said it’s doing whatever it can to reduce higher costs from President Donald Trump’s expansive tariffs from shifting sourcing to changing formulation to avoid duties.

But P&G’s Chief Financial Officer Andre Schulten told reporters on a call that the consumer products giant still will likely have to pass on higher prices to shoppers as early as July.

The consumer product giant reduced its annual financial outlook after reporting lower sales, particularly in the U.S. and Western Europe, during the latest quarter, due to a pullback in consumer spending over worries about tariffs as well as overall financial worries about job security and mortgage rates.

“Everything plays into the consumer behavior,” Schulten said. “Uncertainty around the stock market and what their 401ks are worth and what the portfolio is worth. Uncertainty around the economic outlook and what it means for their livelihood and the job market.”

Pepsi

PepsiCo lowered its full-year earnings expectations, citing increased costs from tariffs and a pullback in consumer spending.

The maker of Pepsi beverages and Frito-Lay snacks said it now expects its core earnings per share to be even with last year. Previously it expected mid-single-digit percentage growth.

A 25 per cent tariff on imported aluminum is among those hitting PepsiCo and other beverage makers. The company expects “elevated levels of volatility and uncertainty” for the rest of this year.

Merck

Merck trimmed its earnings forecast for the year, though it maintained its guidance for revenue.

The pharmaceutical giant has a global reach. Half of its revenue comes from the U.S. market, with the rest of the world making up the other half, according to FactSet. The company expects tariffs already implemented to cost the company about $200 million.

American Airlines

American Airlines withdrew its earnings forecast for the year amid uncertainty over the economy.

While tariffs might not directly impact airlines and other companies in the travel sector, they could prompt a shift in consumer spending. Tariffs typically make goods more expensive and that might force consumers to tighten their budgets and focus more on necessities, while cutting back on discretionary items and services, such as travel.

Southwest Airlines

Southwest Airlines is trimming its flight schedule for the second half of the year due to lower demand. The company also said it could not reaffirm its 2025 and 2026 outlooks for earnings before interest and taxes, given “current macroeconomic uncertainty.”