Deputy minister Gilmour appointed interim CEO of AIMCo after Alberta government fires board

Posted November 8, 2024 2:50 pm.

Last Updated November 8, 2024 5:05 pm.

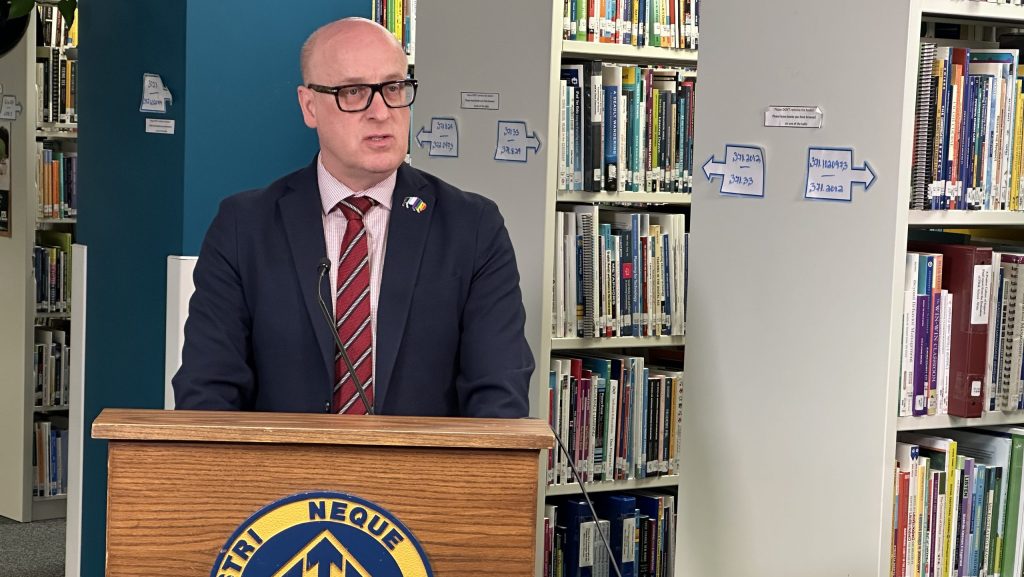

Longtime Alberta bureaucrat and top deputy minister Ray Gilmour has been appointed interim leader of the Alberta Investment Management Corporation, the Crown agency set up to manage public pensions and investments at arm’s-length from government.

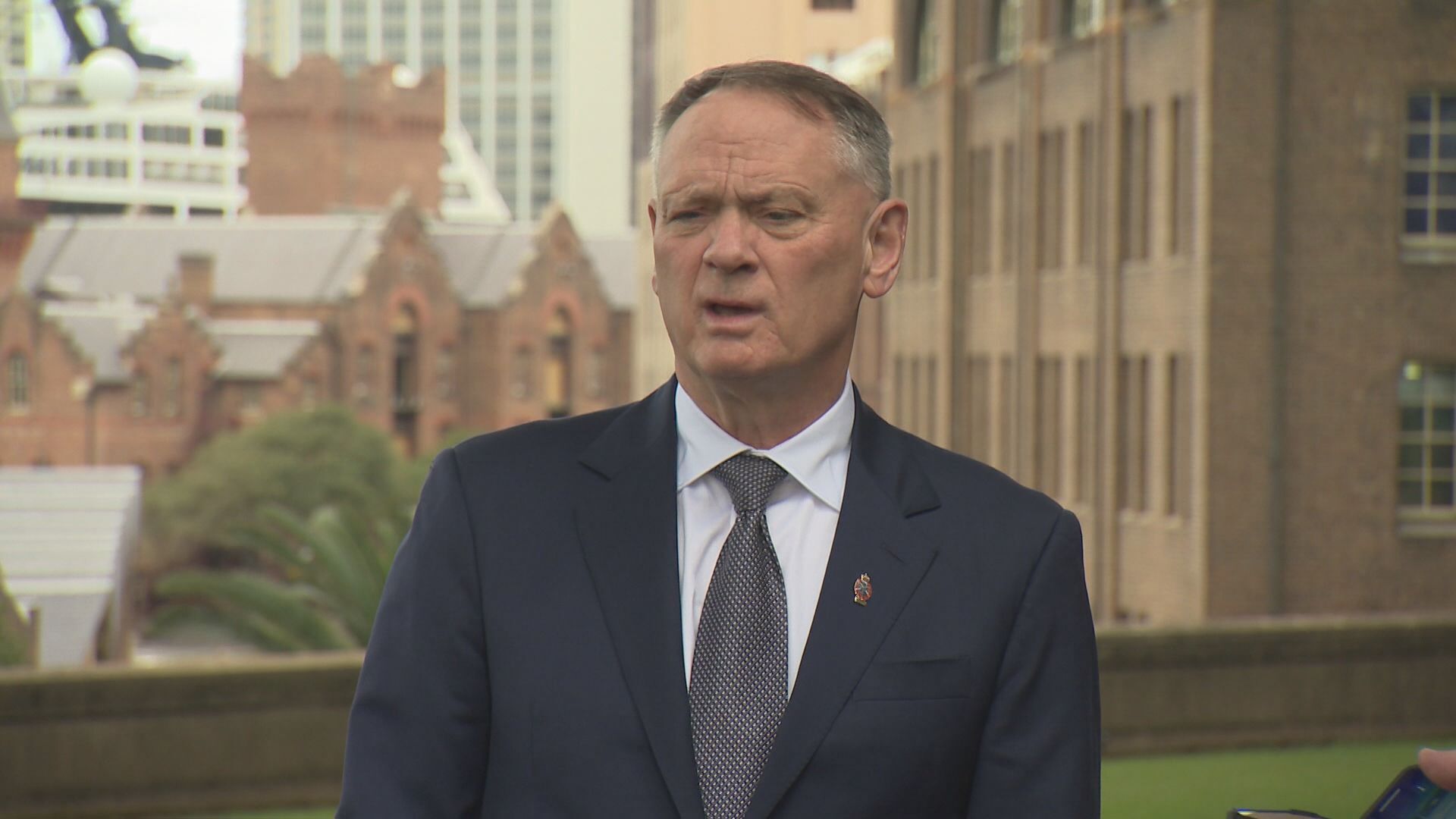

Gilmour’s appointment on Friday came a day after Finance Minister Nate Horner fired AIMCo’s 10-member board and four senior executives. Horner had appointed himself temporary director as well as board chair.

A new chair is to appointed within 30 days and a new board after that.

Horner cited AIMCo’s operating costs, third-party management fees and failure to meet investment return benchmarks as the reason for cleaning house.

As of this summer, AIMCo managed a portfolio of about $169 billion, more than half of which is public sector pension plans for teachers, police officers and municipal employees.

The province says Gilmour has previously served as the deputy minister of multiple ministries, including finance, infrastructure, municipal affairs and sustainable resource development.

It says he also has 15 years of experience in the banking industry.

Horner said Friday in a news release that he’s confident Gilmour would “restore stability” at the agency and bring spending under control.

AIMCo did not immediately respond to an interview request for Gilmour. On its website, it welcomed Gilmour’s appointment and said it’s committed to investing on behalf of its clients and the Albertans it serves.

The province had said that from 2019 to 2023, AIMCo’s third-party management fees increased by 96 per cent, the number of employees increased by 29 per cent, and wage and benefit costs increased by 71 per cent.

These costs all increased, it said, while AIMCo managed a smaller percentage of funds internally.

“We’ve been watching this closely, and it was my determination it wasn’t going to change without a major reset,” Horner told reporters Thursday, adding failure to meet investment return goals in light of the increased operational costs was a contributing factor.

AIMCo’s 2023 annual report says the corporation failed to meet its overall return benchmark in three of the last five years.

In 2023, the fund manager’s goal was to see an overall return of 8.7 per cent. But asset growth reached 6.9 per cent, as investments in infrastructure, renewable resources and real estate significantly underperformed.

AIMCo is also responsible for managing the Alberta Heritage Savings Trust Fund, a rainy-day pot in which Premier Danielle Smith has pledged to stash over $250 billion.

The province says the fund currently has close to $23.5 billion in assets.

On Thursday, the government issued an order-in-council that “approves the incorporation of a provincial corporation for the purpose of managing and investing all or a portion of Crown assets.”

Horner’s press secretary, Justin Brattinga, said in an email that the new unnamed corporation is a preliminary step in the government’s effort to grow the heritage fund.

“We will have more to say on that before the end of the year,” Brattinga said. “The establishment of the corporation is not related to the actions taken (Thursday) in regards to AIMCo.”

Alberta Federation of Labour president and former Alberta NDP leadership candidate Gil McGowan said in a statement Friday that the sudden firing of the board was “more than a little disconcerting.”

“Workers with money in pensions need to know they are secure,” McGowan said.

“So, when the government fires the board and replaces them with one person, the Minister of Finance Nate Horner, we’re more than a little concerned.”

McGowan also said the firing calls into question the ability of AIMCo to be a trustworthy manager of a potential provincial pension plan.

Smith has said that Alberta creating its own pension plan, similar to Quebec’s, by pulling out of the Canada Pension Plan would lead to lower premiums and increased benefits.

But Smith said better benefits at a lower cost is only possible if Alberta is given the $344 billion it considers its share of the national retirement fund, which totals nearly $647 billion.

The CPP Investment Board countered last year with an estimate that Alberta’s contribution is closer to $100 billion.

The chief actuary of the CPP has been tasked with reviewing the issue and producing another estimate. A spokesperson for federal Finance Minister Chrystia Freeland said that work is ongoing and there is no date for when that estimate will be published.

Horner said the dismissal of AIMCo’s leadership is completely unrelated to a potential Alberta pension plan.

McGowan said the firing doesn’t inspire much confidence.

“Precipitous actions like this do not inspire confidence that the UCP can be trusted with the retirement savings of hundreds of thousands of Albertans, or that they can be trusted to successfully and safely run an Alberta-only alternative to the CPP.”