Albertans doubt $334B CPP entitlement outlined in LifeWorks report, panel chair says

Posted December 8, 2023 8:52 am.

Last Updated December 9, 2023 12:23 am.

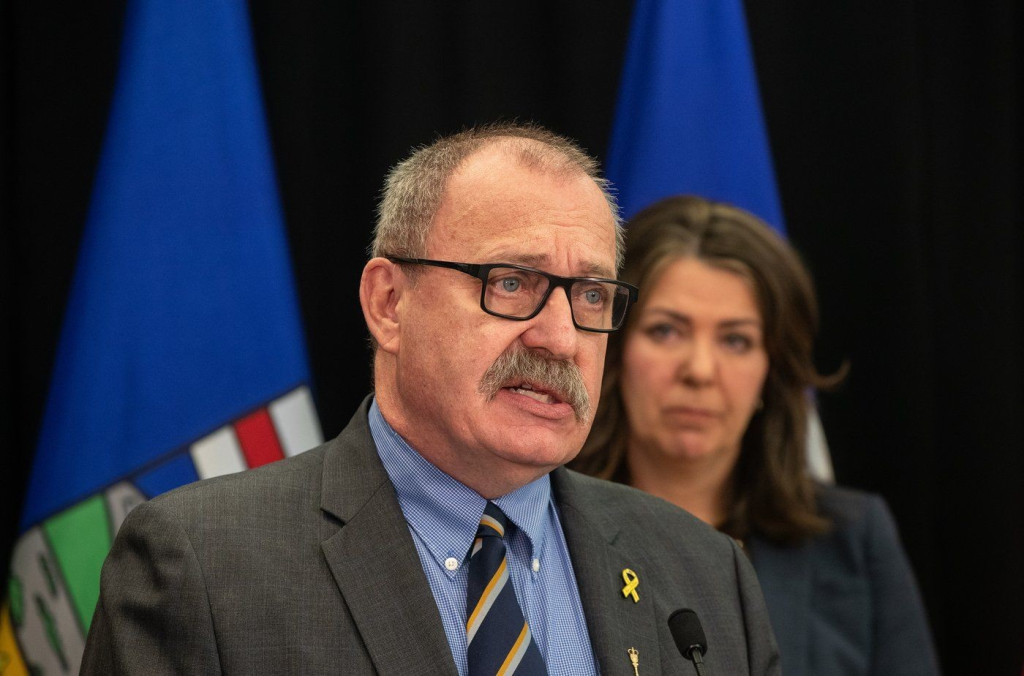

Alberta’s Minister of Finance Nate Horner and Alberta Pension Plan Panel chair Jim Dinning are out with their findings from the first phase of the public consultation process.

After months of collecting feedback on their plans to leave the Canada Pension Plan, Horner and Dinning announced the next steps at a press conference Friday.

During these town halls, Dinning said many of the 76,000 participants said they were against the switch, with a common factor being their doubts on the LifeWorks report, which says Alberta is entitled to $334 billion of the CCP’s assets, if it were to leave.

Horner says many people were opposed to the switch because they question the report’s accuracy.

“When I was first briefed on the LifeWorks report, I had many of the same questions,” he said. “I did see the potential and now understand the importance of province-wide deliberation on the promise to report holds, but also see the need for assurances while we have these important discussions.”

Dinning said they’re now planning to address those concerns.

“The federal government has committed to ask the office of the Chief Actuary for it’s perspective in this regard,” he said. “While that perspective may not settle the mattler conclusively it will provide additional context and assist to making our panel’s conversations with Albertans more productive.”

Without this clarity, Dinning says it’s been hard for many Albertans to form an opinion.

The province is hoping to get a response from the Chief Actuary by mid-February, but Dinning says they don’t have an expected timeline.

This changes the next step in the public consultation process, as the in-person meetings initially supposed to take place in the coming weeks will happen upon the release of the actuary’s findings.

Dinning says during this time, the panel will be turning to investment experts, business groups and seniors groups to nail down other details.

“In the meantime, our panel will engage in other elements of our mandates, such as how an investment fund ought to be managed, how ought to be set up,” he explained. “There’s aspects of benefits administration, there are issues around portability, both inside Canada, and beyond.”